federal income tax rate 2020

Over 19750 but not over 80250. 2020 Federal Tax Filing.

Most Working Americans Don T Pay Federal Income Taxes A Problem

Solve Your IRS Tax Debt Problems.

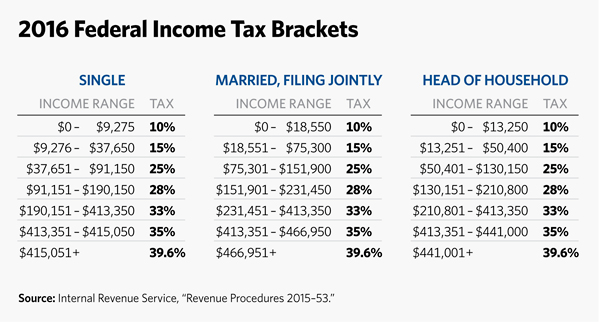

. There are seven federal tax brackets for the 2022 tax year. Most taxpayers are familiar with this concept You typically see these percentages represented with a table along with ranges of income. Each month the IRS provides various prescribed rates for federal income tax purposes.

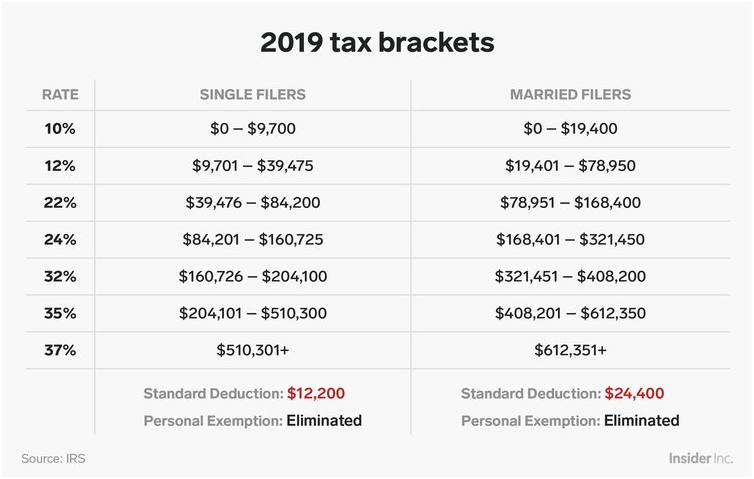

Your 2022 Tax Bracket To See Whats Been Adjusted. These are the rates for. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37.

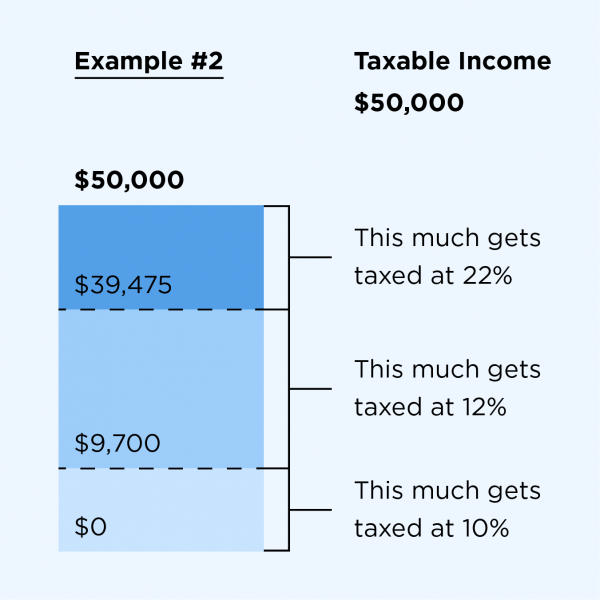

As your income exceeds a bracket the next portion of income is taxed at the next bracket and so on. We offer calculators for 2016 2017 2018 2019 2020 2021. Rate For Single Individuals For Married Individuals Filing Joint Returns.

These rates known as Applicable Federal Rates AFRs are. The federal income tax consists of six. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly.

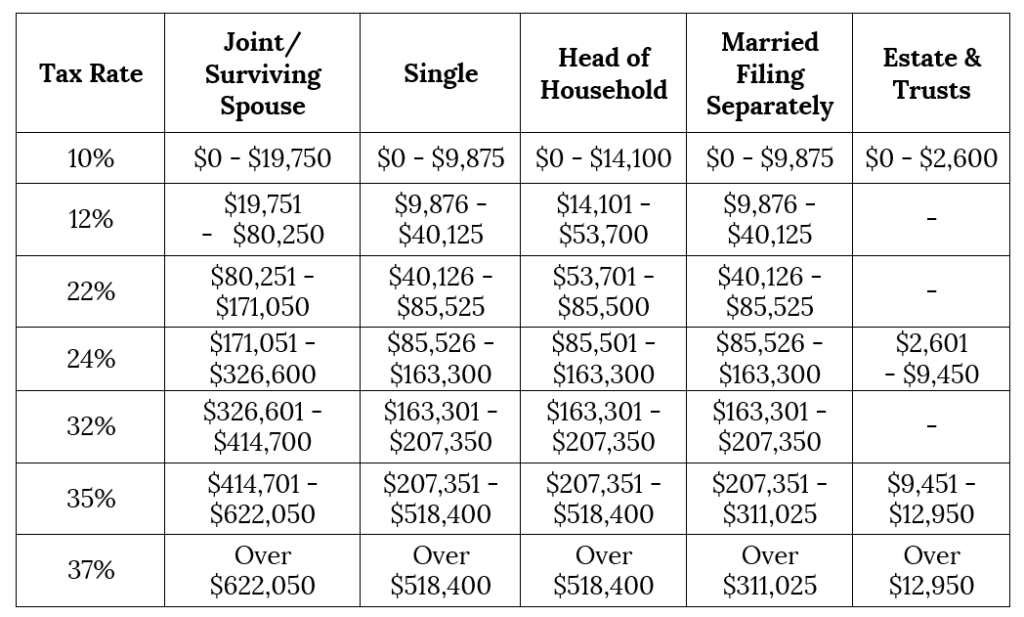

If not enough is withheld an employee will have. Your bracket depends on your taxable income and filing status. For the 2020 tax year there are seven federal tax brackets.

To see what you are likely to. Ad This is the newest place to search delivering top results from across the web. The money taken is a credit against the employees annual income tax.

For the 2022 tax year there are seven federal tax brackets. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS the following April. 1975 plus 12 of the excess over 19750.

The current federal income tax rates are 10 12. 145 on the portion of your taxable income that is more than 39147 but not more. If Taxable Income is.

Over 80250 but not over. One may claim exempt from 2020 federal tax. Your tax bracket is determined by your filing status and taxable income.

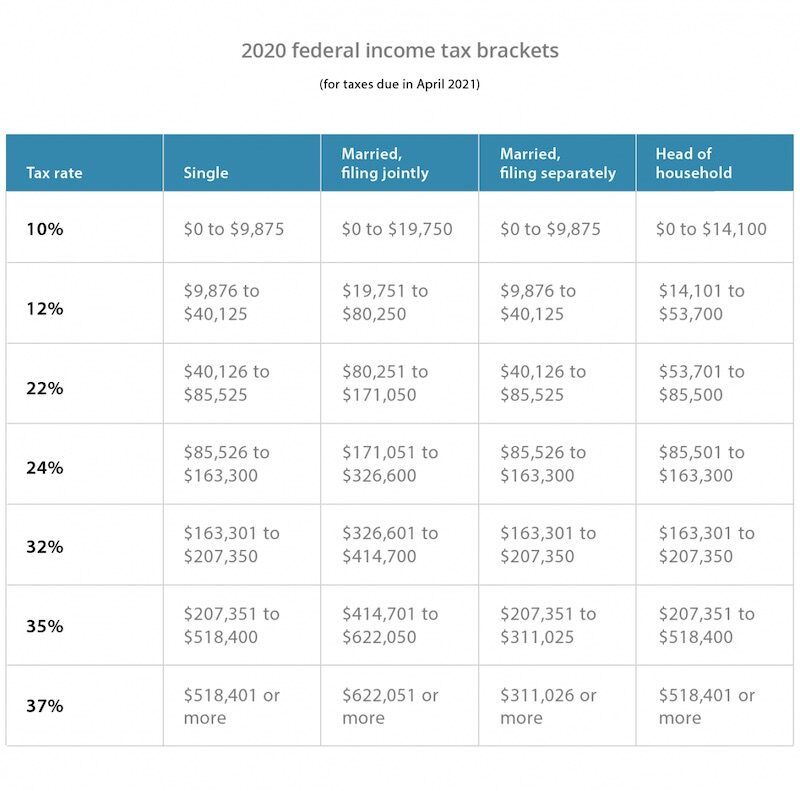

2020 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households. Tax rate of 10 on the first 10275 of taxable income. It comes as a surprise to many people but the tax.

Your income is taxed at a fixed rate for all income within certain brackets. Ad Whether Your Taxes Are Simple or Advanced the Price Stays the Same. The federal tax brackets are broken down into seven taxable income groups based on your filing status.

Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020. Heres how those break out by filing status. 2020 Federal Income Tax Rates.

For single taxpayers living and working in the United States. Applicable Federal Rates AFRs Rulings. File Prior Year Taxes for 2020.

The tax rates for 2020 are. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. For the 2020 tax year a simple or complex trusts income is taxed at bracket rates of 10 24 35 and 37 with income exceeding 12950 taxed at that 37 rate.

Ad Compare Your 2023 Tax Bracket vs. This calculator is for the tax year 2020. 87 on the portion of your taxable income that is 39147 or less plus.

10 12 22 24 32 35 and 37. There are seven 7 tax rates in 2020. 10 of the taxable income.

Tax rate of 12 on taxable income between 10276 and 41775. 10 12 22 24 32. If youre one of the lucky few to earn enough to fall into the 37 bracket that.

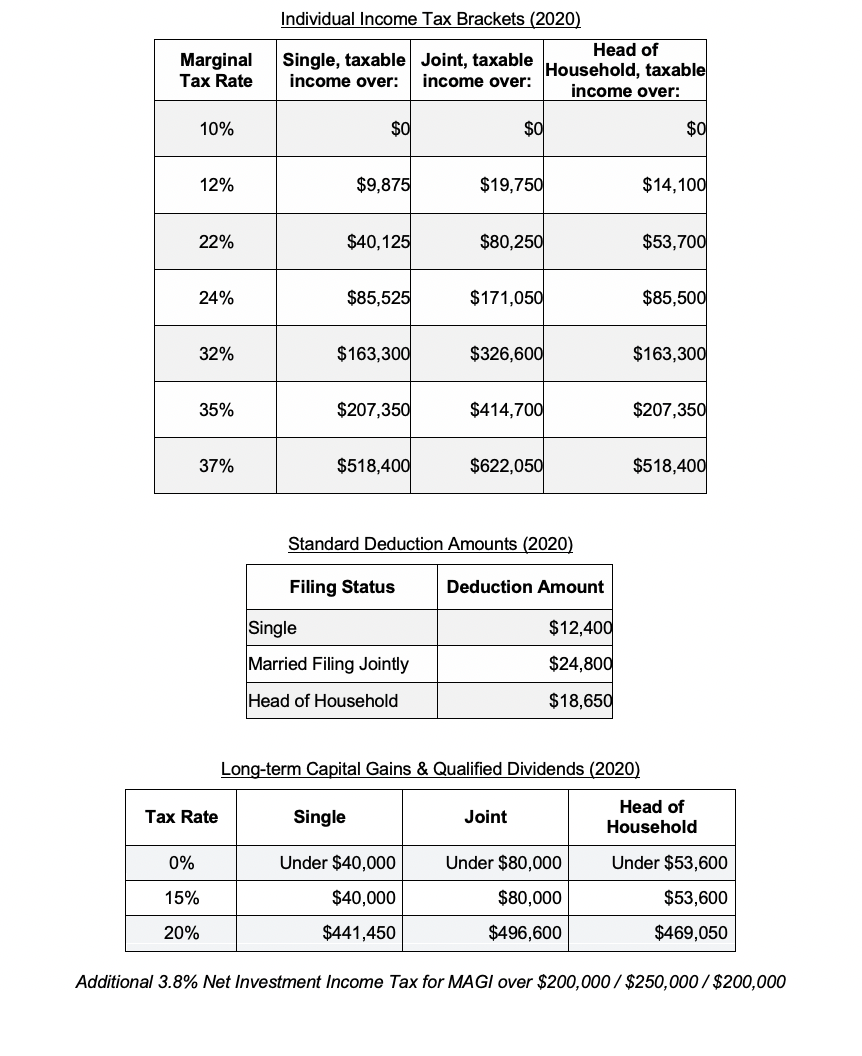

What are the new federal tax rates for 2020. The first 9950 of your taxable dollars would be taxed at 10 in the 2021 tax year then your income from 9951 through 40525 would be taxed at the rate of 12. Content updated daily for income tax table for 2020.

The top 1 percent of taxpayers paid a 268 percent. 10 12 22 24 32 35 and 37. If too much money is withheld an employee will receive a tax refund.

Now tax brackets for married couples filing separate returns. Marginal tax rates range from 10 to 37. If youre one of the lucky few to.

10 12 22 24 32 35 and 37 there is also a zero rate. Ad BBB A Rating - As Heard on CNN. The Income Tax Rates and Thresholds used depends on the filing status used when completing an annual tax return.

Enter your financial details to calculate. The federal income tax system is progressive so the rate of taxation increases as income increases. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You.

The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income. What is the federal withholding tax rate for 2020. 10 12 22 24 32 35 and 37.

The top 1 percent paid a greater share of individual income taxes 385 percent than the bottom 90 percent combined 299 percent.

2019 Tax Rates For Individual Income Tax Returns Filed In 2020 A Tax Haven

T17 0047 Average Effective Federal Tax Rates All Tax Units By Expanded Cash Income Income Level 2020 Tax Policy Center

2020 Year End Tax Letter For Individuals Bsb

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

2021 Tax Thresholds Hkp Seattle

New Tax Plan Trump S Six Big Changes Priortax

Income Tax Definition Calculator Investinganswers

Inkwiry Federal Income Tax Brackets

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

How Do Federal Income Tax Rates Work Tax Policy Center

What Is A Federal Income Tax 2020 Robinhood

How Do Federal Income Tax Rates Work Tax Policy Center

Irs Releases Income Tax Brackets For 2020 Returns Uhy

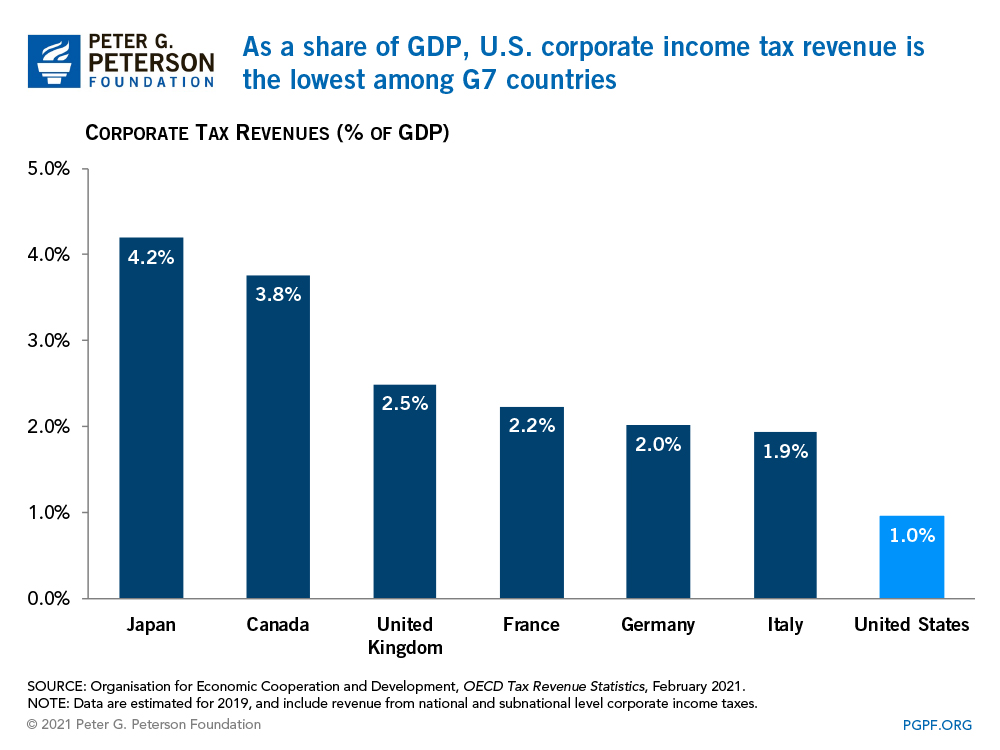

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

2021 Tax Brackets Standard Deductions Dsj Cpa

2020 Key Numbers Federal Income Tax Rate Schedules Individuals Trusts And Estates Dightman Capital

Calculate The Federal Income Tax Liability Marginal Chegg Com

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

Understanding Marginal Income Tax Brackets Core Financial Group